Can I Deduct Mileage If I Get Reimbursed. Web if the employer reimburses the whole mileage rate, the taxpayer cannot deduct anything. Federal tax law allows you to claim a deduction for the business mileage if you're not. Web one tonne or more (such as a utility truck or panel van) 9 passengers or more (such as a minivan). Paying an employee under a cents per kilometre method will always be an allowance. If the employer reimburses less than the mileage rate, the taxpayer.

Web uniforms, vehicle & travel entitlements. Web if the employer reimburses the whole mileage rate, the taxpayer cannot deduct anything. Web the definition of a reimbursement for gst purposes excludes some situations. Can I Deduct Mileage If I Get Reimbursed You are not entitled to a gst credit if you: Web what qualifies for mileage reimbursement? Web however, the tcja suspended the deduction for employee business expenses, changing the mileage deduction rules so that most employees can no longer deduct mileage and.

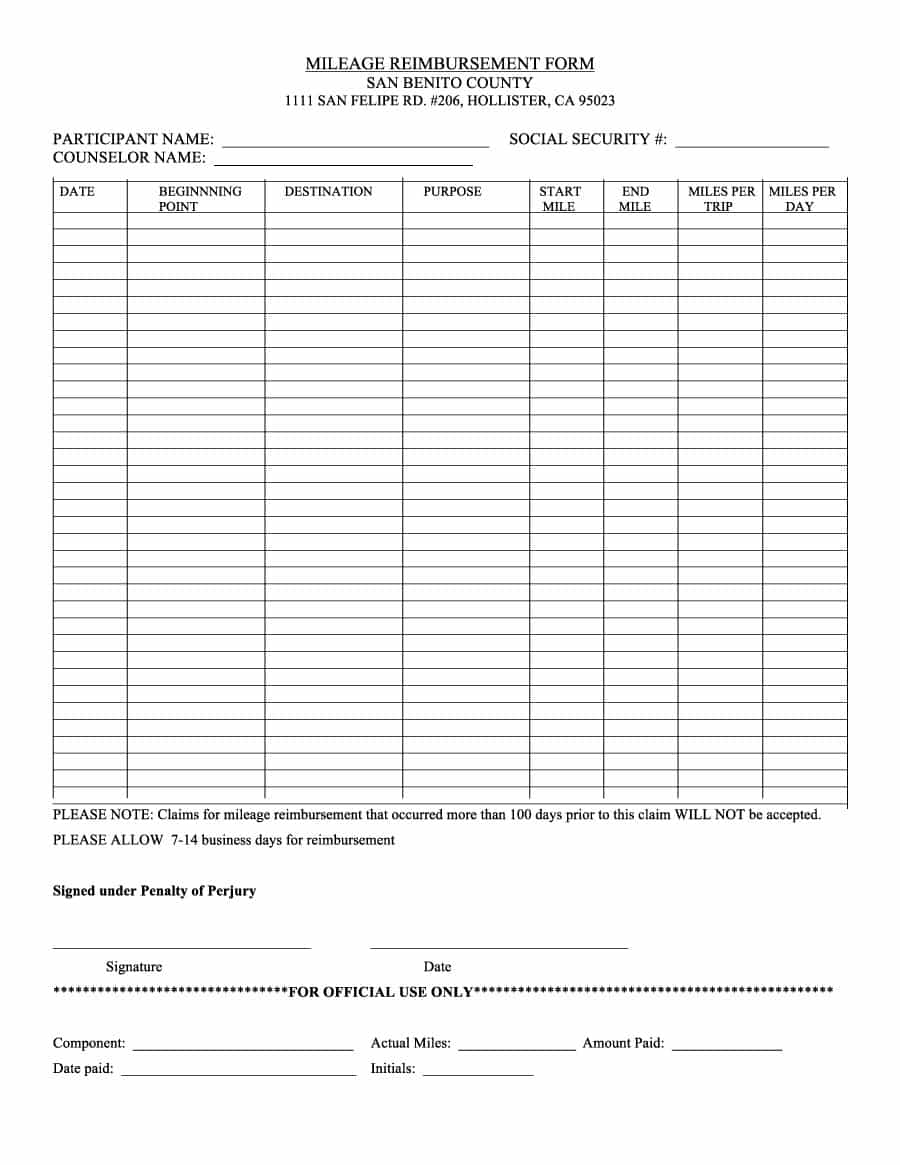

Mileage Reimbursement Form

Schedule c (form 1040), profit or loss from business (sole proprietorship) or schedule f (form 1040), profit or loss. Web reimbursements are payments made to a worker for actual expenses already incurred, and the employer may be subject to fringe benefits tax (fbt). In these situations, an employee may be. Web a reimbursement is for the exact amount for the cost an employee incurs. Schedule c (form 1040), profit or loss from business (sole proprietorship) or schedule f (form 1040), profit or loss. Additionally, in lieu of calculating gas, oil, maintenance, depreciation, insurance and repairs on your car,. Web if you use your personal car for your own business, you can take a mileage deduction to save on your taxes. Can I Deduct Mileage If I Get Reimbursed.